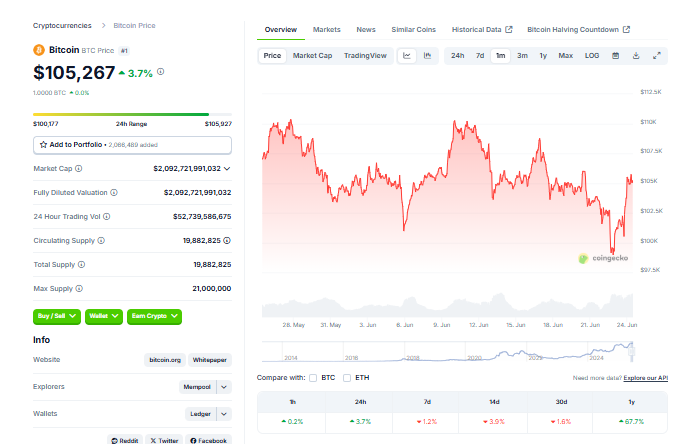

Bitcoin (BTC) settled near the $105,000 level in a constraining pattern of consolidation. That is below dwindling geopolitical tensions and huge inflows into exchange-traded funds (ETFs). Market participants look forward to the possible break point above $109,000 or below $100,000 levels.

Market Dynamics Impacting Bitcoin

The recent rally came after an Iran-Israeli ceasefire announcement, which calmed geopolitical concerns about long-term instability. BTC price rose 3.7% to $105,785. Ethereum rose by a whopping 8% to $2,430. The total cryptocurrency market also rose proportionally, by 4.74% to $3.27 trillion, according to CoinGecko.

BTC Whale Accumulation Patterns

Bitcoin whales have been accumulating BTC on Bybit and other exchanges since the Israel vs. Iran war. This is in line with past trends in prior price rallies, where big accumulation was followed by later price appreciation by 130% to 400%. The Taker Buy/Sell Ratio has risen, symbolizing extreme demand by the big traders, which typically means market bullishness.

Technical Analysis and Future Projections

Bitcoin’s price action is currently moving in a bearish channel, and it is being regarded as bullish flag formation by analysts. A breakdown above is likely to push BTC to the ranges of $130,000–$135,000, and a breakdown is likely to dip to the range of $92,000. On-chain fundamentals reveal a healthy accumulation phase since exchange reserves keep declining.

Prices to Watch

- Resistance: $109,000

- Support: $100,000

- Potential Target: $117,700

Market participants will seek rising volume and confirmation of momentum, which will underpin any breakout above resistance at $109,000. Conversely, breakdown of the $100,000 level would trigger crypto risk-off across the board.

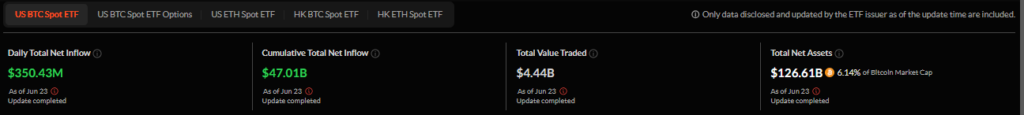

Institutional Support and Regulatory Changes

The latest institutional flows into Bitcoin ETFs, nearly $130 billion now, also support a positive sentiment. Federal Reserve actions like the elimination of the ‘reputational risk’ clause raise the specter of BTC have also been friendly to the market.

Bitcoin’s ascent to $105,000 is traders’ wake-up call. Institutional buying and geopolitical stability in combination could propel outstanding market activity in the near future. Traders need to remain on guard, with the next sessions deciding Bitcoin’s destiny for the next few weeks.