After breaking above the $100,000 mark, BTC dipped by 5%, kicking over-leveraged traders out. Is this just a correction, or will it extend to become a deeper bearish trend? Let’s find out!

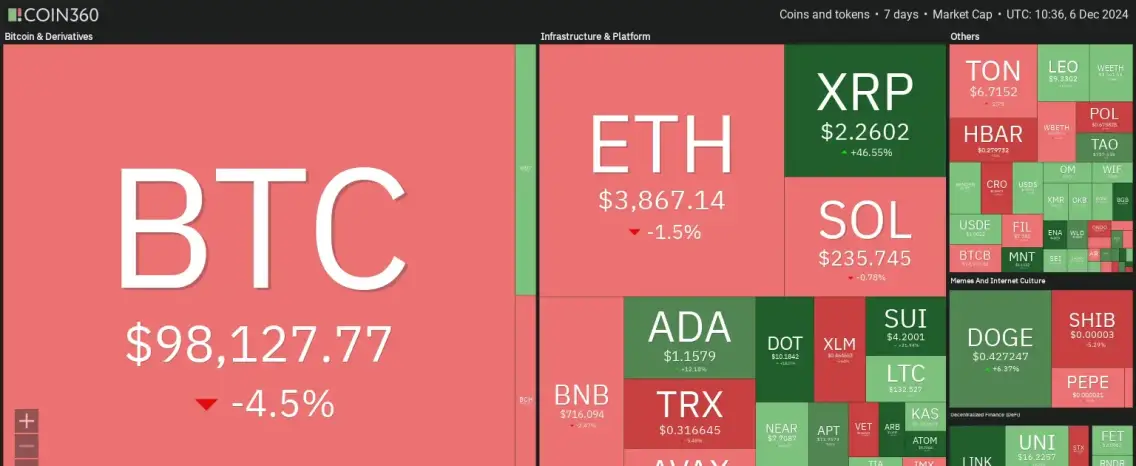

7 Days Heatmap

Yesterday, Bitcoin (BTC) dipped by 4.5%, and Ethereum (ETH) fell by 1.5%. However, this decline wasn’t as severe, as the previous major low remained intact, indicating that the overall momentum is still bullish.

BTC Analysis

BTC has been trading within a rising channel, as marked in red in our previous BTC update.

As long as the $91,500 support level holds, BTC is expected to maintain its bullish momentum.

If BTC breaks below the $91,500 support level, it could signal a deeper correction toward the $80,000 range

ETH Analysis

ETH rejected the $3,500 level like a charm, as expected in our last ETH analysis.

The next resistance is now around the $4,000 – $4,100 zone.

If ETH surpasses the $4,100 resistance level, it could trigger a parabolic movement toward the $5,000 mark.

Quote of the week

Most traders take a good system and destroy it by trying to make it into a perfect system.

~ Robert Prechter

Closing Remarks

In summary, BTC experienced a 5% dip after crossing the $100,000 mark, with over-leveraged traders being flushed out.

Despite this, the market’s overall momentum remains bullish as the critical $91,500 support level holds. A break below this level could lead to a correction toward $80,000.

ETH also faced a minor decline, rejecting the $3,500 level as predicted. The next resistance lies between $4,000 and $4,100.

If ETH successfully breaks above $4,100, it may trigger a parabolic rally toward $5,000. Both assets show resilience, with key support levels maintaining the bullish outlook.

Enjoying these brief market roundups? Dive into our market outlooks for an in-depth analysis and richer insights.