Welcome to another crypto market outlook for the 1st of December!

While BTC, ETH, and OG altcoins are consolidating this week, many alts are pumping like crazy, especially altcoins related to AI and Layer 1 chains. How long will this greed sentiment last? Let’s assess the current situation together from a technical perspective.

Today, we will cover the following topics:

– Market Heatmap and Fear and Greed Index

– US500, DXY and Gold Analysis

– USDT.D, Bitcoin and Ethereum Analysis

– Quotes / Advices

– Closing Remarks

Market Heatmap and Fear and Greed Index

After almost touching the $100,000 mark, BTC has been hovering within a narrow range between $95,000 and $100,000. This gave the opportunity to surge nicely over the past two weeks, led by ETH, which is up by over 8% within 7 days.

The Fear and Greed Index continues to signal “Extreme Greed” this week, with trading becoming more aggressive, particularly in the pumping of relatively small altcoins. Typically, after a couple of weeks of “Extreme Greed,” a correction is expected, so be prepared.

US500, DXY and Gold analysis

As per our last US500 analysis, it continued trading higher toward the upper bound of the macro rising channel marked in brown.

The higher US500 gets, the more probable it is that a correction is getting closer.

As long as US500 is trading within the flat rising channel marked in red, it will remain overall bullish in the short term.

If the $6,000 mark is broken downward, then, and only then, a bearish correction would be on the horizon.

As anticipated in our previous DXY update, the index has retreated after testing the upper boundary of its two-year trading range.

While this upper boundary remains intact, we can expect the U.S. dollar to weaken, returning to its established range.

Despite the DXY’s bearish performance last week, it remains overall bullish in the medium term, trading within the rising wedge pattern marked in red.

A bearish correction would be confirmed only by a break below the entire wedge and the $105.3 low.

After rejecting the $2,500 round number and the lower bound of the rising channel, gold seems to be back on track, doing what it does best – going up.

As the structure in red at $2,625 holds, further upside is expected for gold toward the $2,710 supply zone.

In parallel, if the structure is broken downward, further bearish movement toward the lower orange trendline would be expected.

USDT.D, Bitcoin and Ethereum analysis

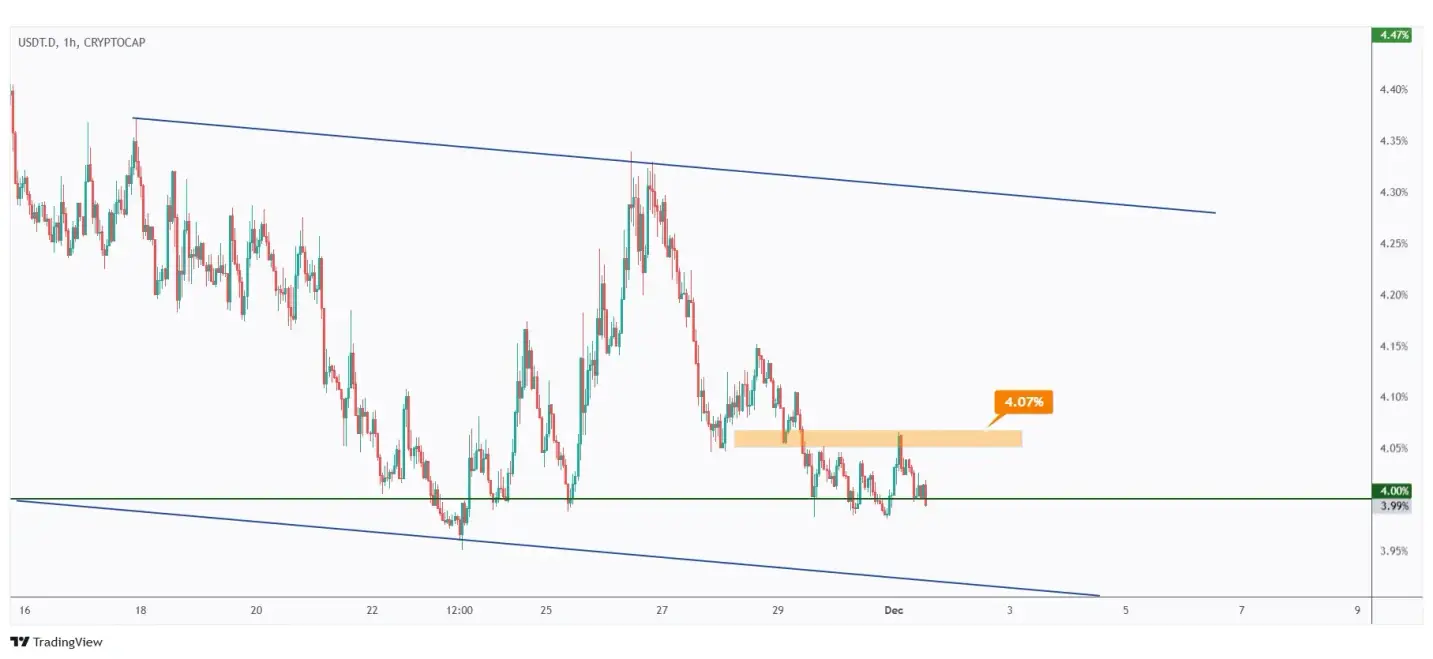

As per our last market outlook, USDT.D is still hovering around a critical zone between 3.75% and 4%.

As long as this support zone remains intact, a bullish reversal is highly expected, which would negatively affect the crypto market.

In the short term, bullish momentum in USDT.D will be confirmed only if the recent high at 4.07% is surpassed.

In parallel, a decline below the 4% level would suggest further downside movement within the support zone.

It is true that BTC rejected the $100,000 round number, but it is still surprisingly strong.

For another parabolic bullish movement for BTC, a break above $100,000 is needed.

The bulls will continue to dominate unless they lose the $94,800 low.

Meanwhile, BTC would keep ranging, signaling an alt season.

As expected in the last roundup article, ETH finally broke above the $3,500–$3,600 resistance zone, signaling the start of the alt season.

As long as $3,500 acts as support, I expect a bullish continuation toward the $4,000 mark.

The bulls are and will remain in control as ETH continues to trade within the rising channel marked in red.

Every bearish correction will now be considered a dip unless $3,500 is broken downward.

Quotes / Advices

Investing is like poker. You should only play the good hands, and drop out of the poor hands, forfeiting the ante.

~ Gary Biefeldt

Closing Remarks

In summary, Bitcoin hovers near $95,000–$100,000, with Ethereum leading the rally, up over 8% in the last week.

The Fear and Greed Index remains in “Extreme Greed,” signaling a potential correction ahead.

US500 continues climbing within its macro rising channel but hints at a nearing correction.

DXY’s medium-term outlook remains bullish, with key resistance levels intact.

Gold resumes its upward trend, eyeing the $2,710 zone.

USDT.D tests critical support at 3.75%–4% with potential for bullish reversal, negatively impacting crypto markets.

Bitcoin remains strong despite rejecting $100,000, while Ethereum confirms the start of an alt season with further upside anticipated.