Welcome to another crypto market outlook for the 15th of December!

BTC is not giving up that $100,000 easily, as the bulls and bears are fighting like never before with no clear winner yet. ETH is also around a strong resistance level and the round number of $4,000, making the upcoming week interesting.

Today, we will cover the following topics:

– Market Heatmap and Fear and Greed Index

– US500, DXY and Gold Analysis

– USDT.D, Bitcoin and Ethereum Analysis

– Quotes / Advices

– Closing Remarks

Market Heatmap and Fear and Greed Index

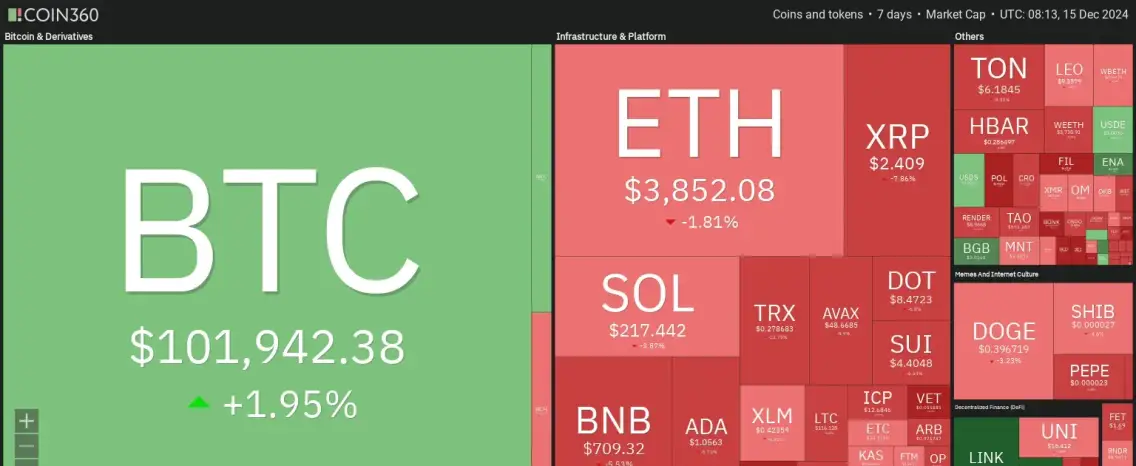

This week has been challenging for new traders entering the market, with the heatmap showing almost all red. Experienced traders, however, recognize this as a signal to accumulate rather than panic.

Surprisingly, the fear and greed index is still signaling extreme greed despite two consecutive bearish weeks. Since the index is typically a lagging indicator, once it cools down and starts showing fear again, it could signal that a bullish reversal is approaching.

US500, DXY and Gold analysis

After breaking above the $6,000 mark, bullish sentiment in the US500 persisted.

The bulls are likely to remain in control in the short term as long as the $6,000 round number holds.

As anticipated in our previous US500 chart analysis, momentum shifted from bullish to bearish after breaking below the $6,060 major low highlighted in red.

As long as the US500 trades within the falling wedge pattern shown in blue, the bears are expected to remain in control.

DXY is retesting the resistance level at $107.5 this week, marking a critical make-or-break zone.

If the $107.5 level is broken to the upside, the bulls are likely to take control in the long term. However, the bears still have one last opportunity to push the price back within the range.

The bullish short-term phase from last week is contained within the rising channel highlighted in red.

If the channel is broken to the downside, the bears will gain the upper hand in the short-term battle. For them to secure a larger victory, a break below the $105.42 structure will be essential.

Gold has been trading bullishly within the rising channel. Although this week has seen bearish movement, it has not altered the overall direction thus far.

The short-term correction phase on Gold is defined by the falling channel highlighted in orange.

It is currently approaching the lower boundary of the blue channel, which intersects with the structure marked in red.

For the bulls to regain control in the short term, a breakout above the orange channel is required.

USDT.D, Bitcoin and Ethereum analysis

USDT.D, mirror, mirror on the wall, what do you reveal today? USDT.D remains my favorite tool for assessing market sentiment through the lens of price action.

As highlighted in my previous USDT.D update, if the 4% support holds and is rejected, it signals the likelihood of continued pain in the crypto market.

As evident from the heatmap mentioned at the start of this article, the overall sentiment is bearish, which explains why USDT.D has been bullish recently.

If the 4.03% level is broken to the upside, expect further increases in USDT.D and additional downside for the crypto market.

BTC has been one of the few bullish assets this week, as shown in the heatmap, holding firmly above the $100,000 mark.

Is BTC dominance making a comeback, or is the alt season still ongoing?

If the $103,700 level is broken to the upside, we can anticipate further gains for BTC.

In parallel, if the $100,000 level is broken to the downside, a short-term bearish correction toward the lower red trendline can be anticipated.

After rejecting the $4,000 resistance level, ETH has been bearish in the short term, as highlighted in our previous roundup article.

As long as ETH remains within the rising channel marked in red, the bulls will retain control, especially if the $4,100 level is broken to the upside.

In the short term, ETH will remain bearish as long as it trades within the falling channel marked in blue.

If the bearish momentum continues, the next rejection is likely to occur at the intersection of the red trendline with the demand zone highlighted in orange.

Quotes / Advices

I think investment psychology is by far the more important element, followed by risk control, with the least important consideration being the question of where you buy and sell.

~ Tom Basso

Closing Remarks

In summary, this week has been marked by significant volatility across markets, with the heatmap reflecting widespread bearish sentiment and the fear and greed index still signaling extreme greed despite recent bearish trends.

US500: Bulls maintain short-term control above the $6,000 level, but a falling wedge pattern suggests potential bearish momentum.

DXY: The $107.5 level remains a pivotal zone, with a breakout signaling long-term bullish control, while bears could re-enter if rejected.

Gold: Trading within a rising channel, its long-term bullish direction remains intact, although a short-term correction within a falling channel continues.

USDT.D: The index has been bullish, reflecting broader bearish sentiment in crypto markets. A breakout above 4.03% could signal further market declines.

BTC: One of the few bullish assets this week, holding above $100,000. Breaking $103,700 could signal more upside, while dropping below $100,000 might lead to a bearish correction.

ETH: Short-term bearish but contained within a rising channel. A breakout above $4,100 could renew bullish momentum, while bearish rejection at key levels could signal further declines.