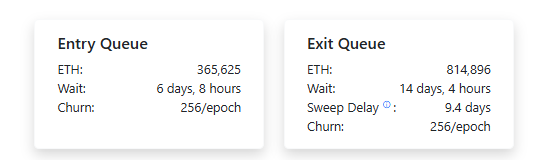

Ethereum (ETH) is also under immense pressure when it comes to its non-ISO 20022 compliance, which is highly critical for institutional adoption. The compliance issue is timely given that Ethereum’s exit queue is record-high at 808,880 ETH valued at around $3.7 billion lined up in the network.

Compliance Issues Affecting Ethereum

Industry leaders emphasize that no digital asset platform can be market leading except if it is ISO 20022 compliant. It will provide uninterruptible communication all around the globe between the payment systems. Ethereum token standards are not ISO 20022 compliant, and that offers hurdles to it being used on regulated financial markets.

A recent SMQKE study accentuates that ISO 20022 conformity is significant to institutions willing to embrace digital assets. Otherwise, Ethereum may not be incorporated into existing financial networks, ultimately hindering its growth.

Unprecedented Exit Queue for Ethereum

Ethereum Validator Queue, meanwhile, has a 14-day wait to exit, an all-time high. It is a result of a run on unstaking, and 808,880 ETH is queued. It has also been debated among crypto investors whether it has an impact on investors.

The rise in exit queue activity has been attributed to several causes like taking profits as Ethereum climbs to its all-time high of $4,891.70. Additionally, anticipation for ETH staking ETFs to be launched has motivated traders to unstake their funds to hold out for these funds.

Reasons Propelling the Exit Queue Boom

The exit queue phenomenon is a wider pattern of shifting investor mood. It is pointed out by analysts that such massive redemptions from pools such as Aave, especially recent like a $600 million redemption by Tron founder Justin Sun, have caused such intense activity in the exit queue.

Also influencing institutional interest is uncertainty in stablecoins and how they are classified. Without the clear regulation of stablecoins, institutions cannot bet everything on Ethereum and other such digital tokens.

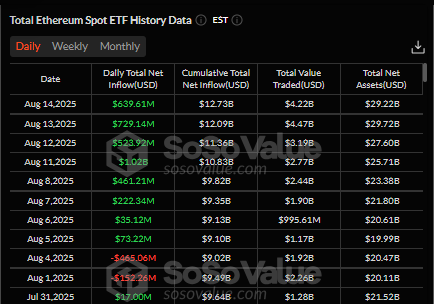

ETF Flows Fuel Price Surge for Ether

U.S. spot Ethereum ETFs pulled in $2.3 billion over six days as of August 14, 2025, driven by institutional investors. BlackRock’s ETHA led with $500.9 M ahead of Fidelity’s FETH at $154.7 M. Inflows pushed ETH above $4,900.

August 13 alone amounted to $729.1M, the second-largest single-day amount since the funds were launched. ETF gain and Ethereum rally saw Standard Chartered raise its year-end goal to $7,500.

August flows reached more than $3 billion, pushing ETF assets to $29.22 billion on a record five-month inflow streak. ETH had an all-time yearly high price of about $4,765.83, rising by almost 20% for the week.

In addition to record-length departure queues, these issues also highlight the need for Ethereum to enhance its regulatory harmony and operational alignment with global financial infrastructure. As things continue unfolding in the crypto world, whether Ethereum will be able to survive these issues will be what makes or breaks the platform’s sustainability.