Bitcoin’s persistent price level above $90,000 compelled the wider cryptocurrency market into a 10.1% weekly increase, taking overall market capitalization to $3.04 trillion from $2.76 trillion. Ethereum outperformed Bitcoin with a 12.12% increase, driven by network upgrades and investor demand.

The strength of the market is being met with decreasing trade tensions globally and ongoing institutional investment, led by spot Bitcoin ETFs.

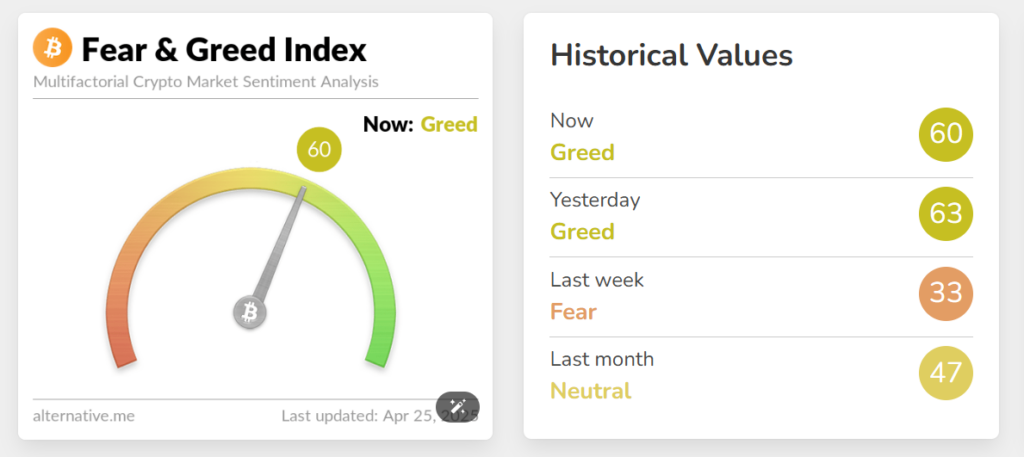

Sentiment Falls Short of Market Strength

While Bitcoin has fluctuated between $91,800 and $94,300 along the way, the Crypto Fear & Greed Index dropped from 72 to 60 from April 23 to April 25. The drop indicates investor wariness that the rally cannot be sustained.

Markus Thielen of 10x Research reported low stablecoin minting volume, normally an indicator of notable upcoming market activity. Bitfinex analysts additionally pointed out that Bitcoin’s relative strength against equities still needs to be structurally validated.

In spite of that, there are a couple of bulls in the market. Michaël van de Poppe of MN Trading Capital indicated that further buying pressure can push Bitcoin to a new all-time high.

Ethereum and Altcoins Post Substantial Gains

Ethereum’s 12.12% weekly gain came after a major proposal by creator Vitalik Buterin to swap out the Ethereum Virtual Machine for RISC-V, an update that could have long-term consequences for the network’s scalability and performance.

Solana also made headlines by revising its validator requirements to reduce centralization. Other altcoins such as Sui (SUI), Stacks (STX), and Bittensor (TAO) registered substantial gains.

Institutional Activity and Policy Developments Bolster Outlook

Michael Saylor’s company purchased another 6,556 BTC at a mean price of $84,785, increasing its holdings to 538,200 BTC. Cantor Fitzgerald also initiated a Bitcoin treasury program, and $3 billion has been pledged by institutions such as Tether and Softbank.

Policy-wise, remarks by former President Donald Trump and European officials regarding the tariff cut with China have helped sustain better market sentiment, prompting a risk-on behaviour.

ETFs, DeFi and Market Infrastructure Keep Expanding

U.S. spot Bitcoin ETFs saw $2.6 billion in net inflows this week, their third strongest week since inception.

In decentralized finance, Circle launched a global payment network for USDC and EURC, and Orca and Fuel Network launched major token buyback programs.

Meme coins also gained traction. TRUMP token holders will get to be at a private dinner with President Trump in May, further intensifying the desire for niche assets.