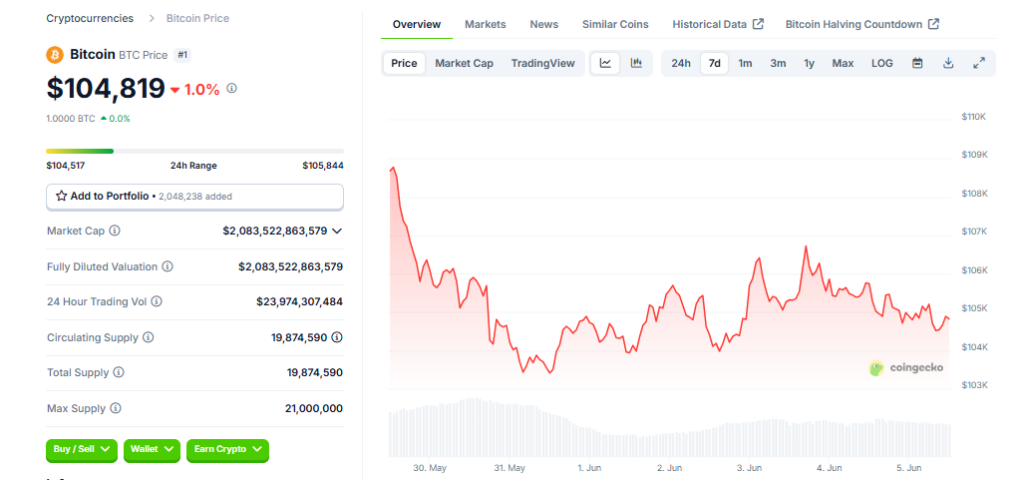

Bitcoin price remains steady as it holds above $104,500 amid rising concerns over US national debt. It is lower than yesterday’s $105,434. Economists cautioned that without fiscal reform, Bitcoin would be an even bigger player in world finance.

Economic Factors Affecting Bitcoin

Some of the recent comments from central figures such as Coinbase CEO Brian Armstrong give insight into the potential fate of speeding up US national debt. Armstrong commented that if the electorate continues to keep Congress in check so that deficits are lowered, Bitcoin can grow as a reserve currency. He also said that there must be fiscal discipline to promote economic stability.

Likewise, Elon Musk also repeated the same concerns by asking about interest payment weights which eat up 25% of government expenditure. Musk warned that running a deficit would be setting aside funds for interest payments and nothing at all for any other government move.

Profit-Taking by Bitcoin Whales

Simultaneously, colossal profit-taking from Bitcoin whales was also witnessed. Data from Glassnode indicates that cash-outs have already crossed $500 million hourly. The trend indicates the fact that large holders are profiting from recent gains, and it makes the market volatile.

Market analyst Willy Woo revealed that whale entities reduced their total holdings by approximately 40% in the past eight years. The decline is a reflection of strategic readjustment as whales adjust to market price action and sentiment.

Future Outlook for Bitcoin Price

Even though there is widespread economic stagnation, there is still some positive news regarding Bitcoin. Experts have indicated that institutional demand still remains. Bitcoin ETFs, for example, broke a three-day trend of outflows with $375 million inflows, signaling growing investor confidence.

But concerns remain regarding potential price correction. Price volatility of Bitcoins has also raised concerns regarding the stability of corporate treasuries held in Bitcoins. According to analysts, if prices fall sharply, particularly below the psychological $100,000 level, then liquidation will take place, leading to further market dislocation.

Currently, 61 listed companies own 673,897 BTC, or approximately 3.2% of all Bitcoin mined to date, according to Standard Chartered’s Geoff Kendrick. Although treasuries of Bitcoin add buying pressure at first, there might be a reversal in forces which would eliminate such impact.