The crypto market is declining as investors lock in gains after the latest boom. Bitcoin (BTC) fell to $116,404.10, and Ethereum (ETH) fell to $4,518.88. XRP and Dogecoin fell as well, reflecting a trend in the market.

Market Overview

Bitcoin prices fell 0.61% in the last 24 hours, as per on-chain statistics, while Ethereum fell by 1.54%. XRP was at $3.03 and fell by 1.31%, and Dogecoin was at $0.2718 and fell by 2.45%.

This market correction comes after a strong rally, especially for Bitcoin, which recently regained a two-year trendline that in past occurrences has led to larger market rallies. Crypto trader Moustache explained that in past occurrences where this trendline was regained, market prices sharply increased across the board.

Coinbase Reserves Hit $112 Billion

Recent reports showed that reserves on Coinbase reached $112 billion since November 2021. The assets involved are Bitcoin, Ethereum, and ERC-20 stablecoins. The rise in the reserves shows greater confidence in the crypto market by retail and institutional investors.

The rising reserves are usually accompanied by heightened market liquidity and adverse price momentum. The last time reserves reached this high, the market peaked during the previous bull cycle, indicating a potential surge ahead.

Profit-Taking Trends

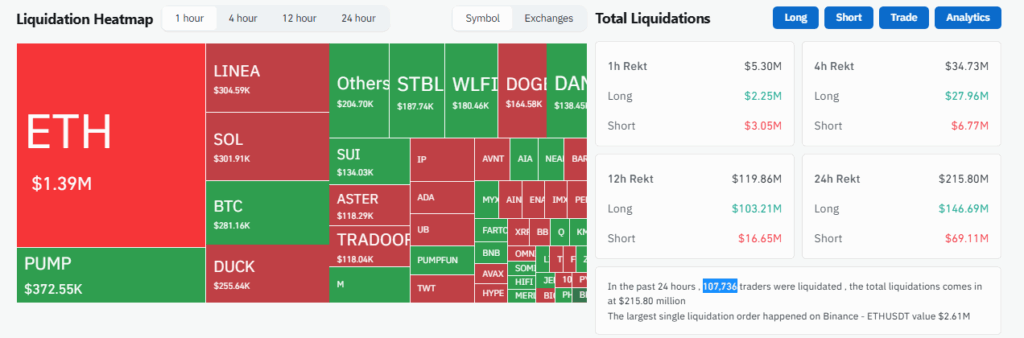

Statistics from Coinglass show that over 107,736 traders faced liquidation in the last 24 hours, totaling $215.76 million. Pressure driving prices lower is caused by this profit-taking. Net outflow of $163 million was recorded in spot Bitcoin ETFs while Ethereum ETFs experienced net inflow of $213 million on Thursday.

These trends indicate that investor sentiment shifts with some opting to take profits when prices are in motion. Market volatility will be sustained, particularly as traders respond to macroeconomic happenings such as the recent 25-basis-point cut in interest rate by the U.S. Federal Reserve.

The crypto market is currently down as traders are locking in gains. But the accumulation in Coinbase reserves suggests institutions continue to be keen on it. When the market comes back into balance, traders will be closely looking for signs of a recovery or further decline.