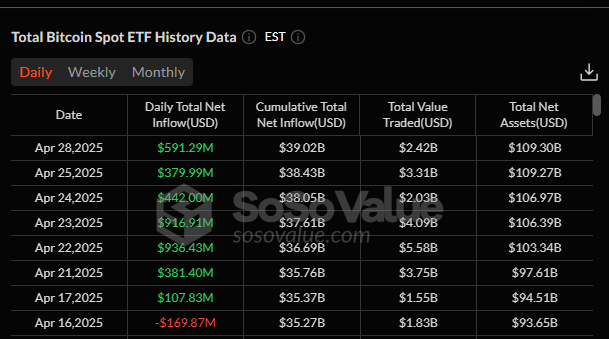

Bitcoin ETFs inflows hit $3.75 billion in seven days, indicating rising institutional demand. This week was the strongest week on record for spot Bitcoin ETFs since they were approved in January in the U.S. This was the most consecutive days of net daily inflows in months.

Demand is a positive sign of improved investor optimism behind financial products backed by Bitcoin amidst volatility in global markets.

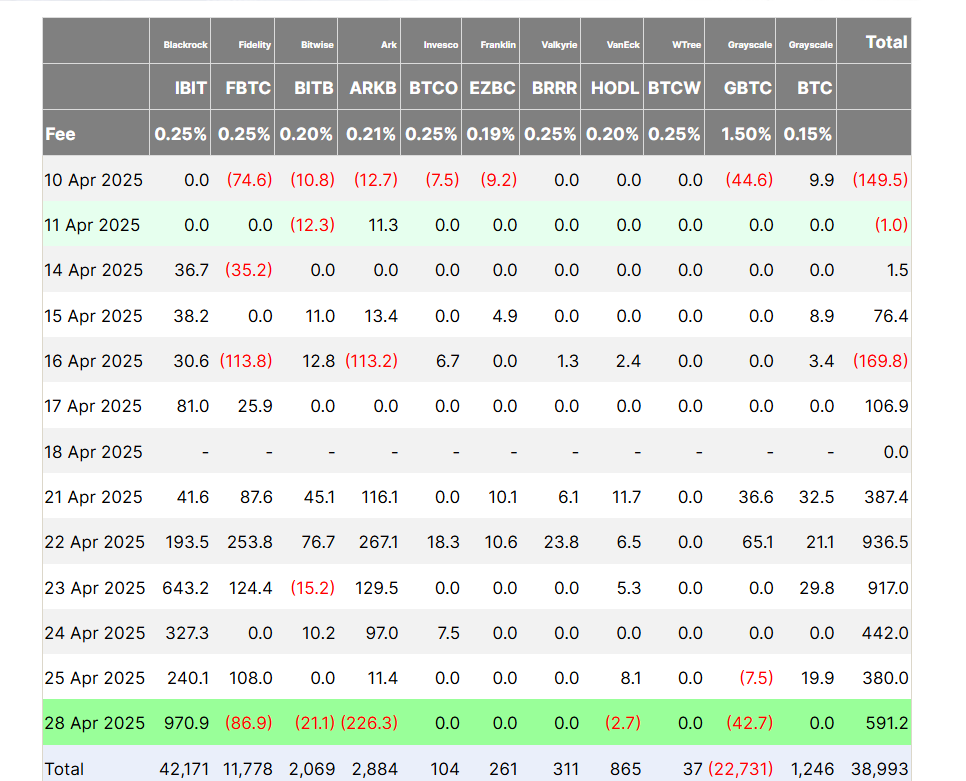

BlackRock’s IBIT Leads Bitcoin ETFs Inflow

BlackRock’s iShares Bitcoin Trust (IBIT) took the top spot, with $971 million in one-day inflow, its second-largest single day since inception. IBIT’s performance well outpaced outflows from rival funds.

ARK 21Shares Bitcoin ETF (ARKB), for example, saw a $226 million outflow, as other ETFs reported smaller net flows. Following those redemptions, combined net flows across all ETFs amounted to $591 million for the day.

Defensive Sentiment Despite Bearish Derivatives Signals

While the Bitcoin ETFs inflows are still strong, the derivatives market tells a different story. BeInCrypto finds more appetite for bear options, which suggests that there is some hedging against possible losses.

This contrast between derivatives activity and ETF demand demonstrates the overall caution in the market despite capital inflows in spot products.

Bitcoin Stays Strong Above $94,000

The price of Bitcoin has held firm against changing sentiment. It trades at around $94K to $95K on Tuesday, buoyed by levels amid ETF inflows. Analysts are closely monitoring whether institutional demand will sustain price momentum.